At our All Agent Compass Meeting on Tuesday, Economist Todd Britsch from MetroStudy gave us in the Puget Sound area (and Washington state as a whole) positive news about trends and

anticipated growth through 2021. Although our market is becoming more balanced with greater inventory available, our area continues to have huge growth and more buyers than sellers and interest rates make buying right now very attractive.

Compass

DID YOU KNOW? BOFA Chief Economist Michelle Meyer provided a great summary of the US economy worth sharing...

DID YOU KNOW?

Information provided by Compass Guru Leonard Steinberg

At yesterday's Compass/Bank Of America meeting, BOFA Chief Economist Michelle Meyer provided a great summary of the US economy worth sharing:

* It’s all about the FED.

* We are in the 10th year of the business cycle, the longest ever.

* Business cycles don’t end because of old age, they usually do so because of vulnerability or shocks.

* The only shock right now is the trade wars. This could shift the entire global mentality of our economy if they continue or expand.

* Confidence is down.

* Domestically oriented components are strong. Slightly weaker but strong. International markets are not as strong.

* The US consumer is super strong.

* Unemployment is strong.

* Housing shows some areas of price stretching, mostly on the west coast. Pricing in some areas may be a little too inflated.

* The backdrop is solid for housing.

* The economy still has room to grow still for the next 6-12 months.....except for the trade wars. They are a cloud over the economy.

* The upcoming G20 summit may reveal an agreement or direction to a resolution.

* So far most consumer goods have avoided tariffs....if that changes, all could be different.

* We are in the midst of the crosshairs.

* The Fed watches all this closely. Chances are rates will be cut to offset any risks imposed by tariffs. September is likely, possibly sooner. Low interest rates bode well for the housing market.

* The 10-year treasury rate is down 50% compared to a year ago.

Watch the following indicators:

1. The Labor market. Job creation is key. Last month showed dramatic slowing. Was it just a single month blimp?

2. Wage growth shows the ability of the consumer to spend.

3. What are the market signals? Right now stocks are high and bonds are low. The yield curve is inverted, indicating the bond market believes a recession is imminent.

Key takeaway: The last recession was unusual in that it affected the ENTIRE US housing market. Today, with much more banking and lending regulation the chances of that repeating are lessened considerably. Housing 'recessions' are much more localized based on local economies and supply/demand.

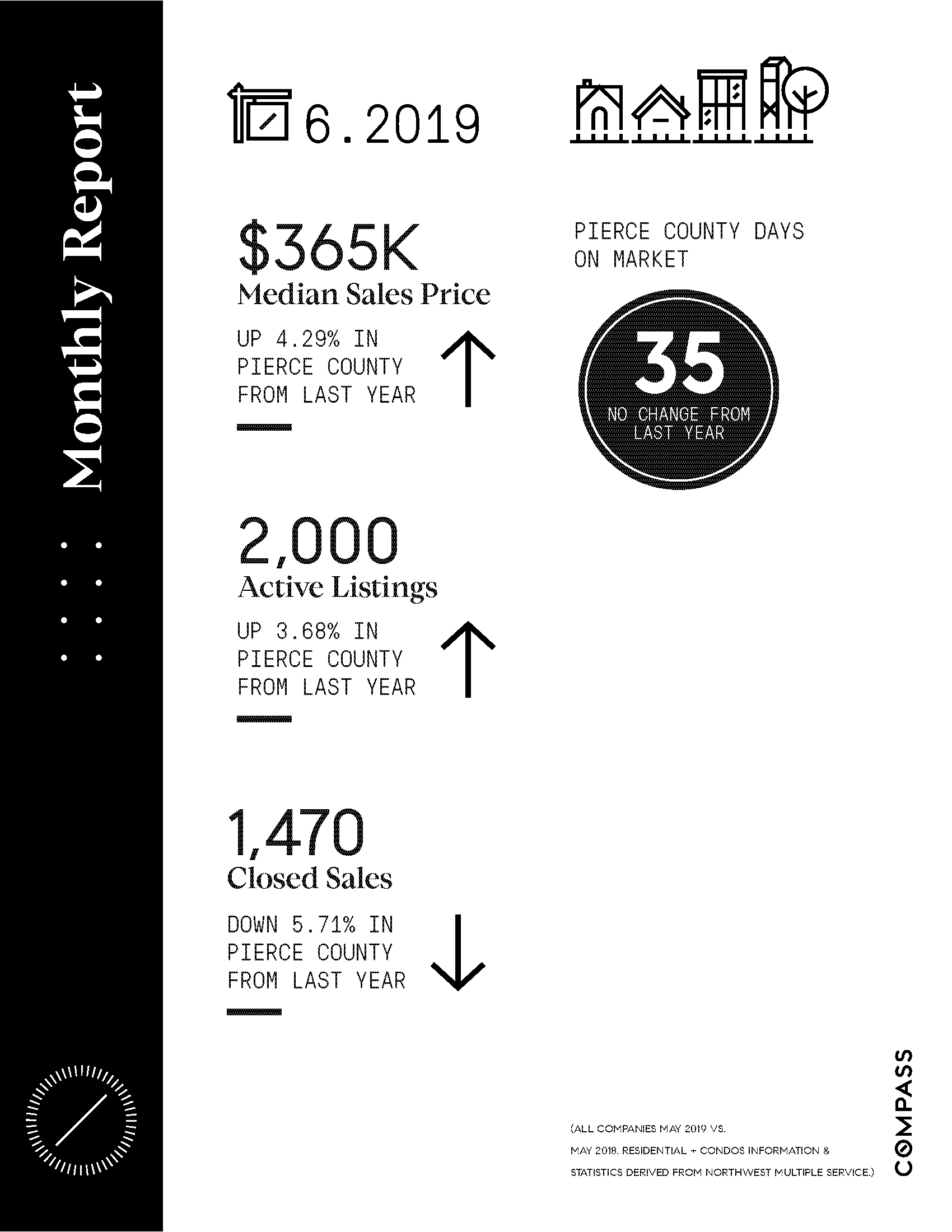

Market Report for June 2019 presented by Chris Doucet

Our latest #MiniMarketReport is out, and the name of the game for May was Momentum! With low interest rates, strong job growth, and brokers adding new listings to inventory, we saw a strong start to the peak season with brokers reporting busy open house traffic and increased activity. We predict a solid summer for both buyers and sellers; with the increased inventory, buyers have more choices so sellers should enter the market “show ready” with a solid marketing strategy in place. Reach out for more information on being successful in the summer market. #MarketLeaders

The haves and have nots… The real estate industry is changing dramatically.

Written By Chris Doucet

The haves and have nots…

The real estate industry is changing dramatically. Two trends are becoming more and more apparent and dissimilar. One school targets bargain sellers and the other believes that full service is still the best way to represent sellers with, likely, their most significant investment.

Redfin started the trend of offering discounts on home sales. With Refin there are lots of moving pieces. The listing agent that you meet initially is not the agent who markets and transacts the sale, does the inspection and presents the property to best advantage. Services are a la carte. You want more, you pay more. Agents are much less important in the process as is the consistency of representation.

My brokerage, Compass, stands at the other end of the spectrum. A customer driven orientation is our goal with high touch agent interaction, full service and a seamless sales experience that is geared to getting you the very best price.

In keeping with the newest trend, both companies are technology driven. That is where the commonality ends.

In my decades of real estate experience, I have always offered this concierge focus. From branding the property, creative and innovative marketing, staging, home prep and project management plus constant interaction with the client, my goal is to make the selling experience as easy and seamless as possible.

I had always hoped but never anticipated aligning myself with a brokerage that not only felt the same way but added a smorgasbord of services (for instance financing home improvements up front until the home closes with Compass Concierge) immediately available to us. Of course, I have my stable of service providers who are tried and true but Compass adds another layer to allow me to streamline my representation. Add to that Compass’s ever improving technology, it is an unbeatable combination.

You make the choice.

Seattle & Eastside Market Report for March 2019

After King County home prices fell to a two-year low in January, the market is already showing signs of a rebound. With more inventory available, buyers now feel like they have something to shop for. Inventory = Opportunity. Not shown in the year-over-year stats: February saw multiple offers returning in some areas. While prices are down from this time last year, the current market is healthy for both buyers and sellers, and having an experienced agent who can translate year-over-year stats vs. real-time conditions is critical. Want to know more? I also have reports for Snohomish and Pierce counties as well.